MFC Investment

Leverage this compelling long-term investment with historically attractive risk-adjusted returns.

Call Us for Service

+254 713 331108

Minimum capital investment

(Ksh 1,522,103)

Monthly interest Earning

Annual interest

Monthly interest earning

(Ksh 53,274)

Renewable Contract terms

GROW NATURALLY

Why you should join this export investment

- Investing is a long-term strategy for building wealth. The most successful investors invest early, then allow their money to grow for years or decades before using it as income. Constantly buying and selling investments is likely to make less money than a buy-and-hold strategy in the long run.

- Money is a tool that can help you to achieve your goals. It can provide comfort and stability for your family, make it easier to plan for the future, and allow you to save towards important milestones. But to achieve these things, you need to know how to make your money work for you.

- There is no reason for anyone to limit themselves to one type of investment. The best option is to have a portfolio that is diversified. This is the best way to achieve a strong portfolio and knowing that many types of investments that are available and how they work is the best way to achieve wealth.

Our Investment Process & Philosophy

With an unwavering commitment to our disciplined and conservative investment philosophy, we develop farms funded by our investors based on our market contractual demand and available resources to make each venture a success.

How We Invest

We take into account climate change, water availability, structural regional trends, regulatory landscapes, and long-term trends in improvement in agricultural yields.

End Market Analysis

We dive deep into the end markets for the farm products we target to determine how long-term trends in the industry may influence end prices. We choose high value produce fit for international market and offer reasonable returns to our investors.

Due Diligence

Our 105-point due diligence checklist includes soil, leaf, water, capital improvements, title, local legislation, and depth of the supporting farming ecosystem, cost of inputs, farmworker wages, and more.

Crop season vs market

We incorporate 150 data sets from public, private and proprietary data sources when analyzing crop season and market and its effect to every investment. The balance is simple, winter and summer which we prioritize to make 100% sales during winter and 50% during summer.

Acquisition Criteria

SOIL click

Soil quality is a fundamental determinant of farmland productivity and therefore of its value. In considering farmland for purchase, we take soil tests to determine if it’s fit for production

WATER

Appropriate water availability is an essential input to farming and key consideration in determining the productivity and value of farmland. We seek to acquire farmland where water availability through precipitation and irrigation meets the agronomic needs of the crops expected to be grown

CLIMATE

Crops have particular climatic growing requirements. We believe that diversification within and across core farming regions and crop types provides significant annual and long-term risk mitigation for our investors. Africa is blessed climatically.

MARKET

Fresh herbs are growing in popularity as consumers are in natural healthier products and new culinary experience.

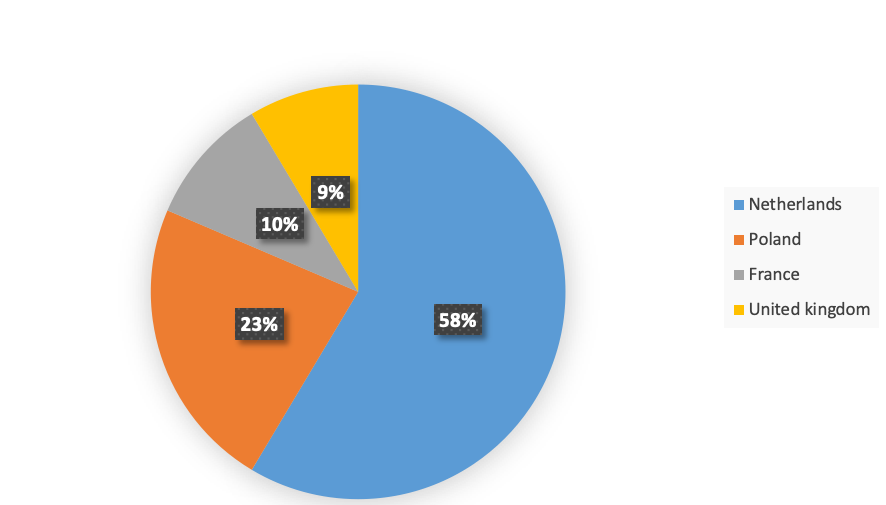

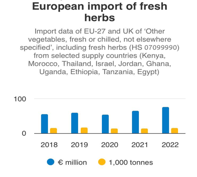

Our Market